BlueFive Capital, a rapidly emerging investment platform founded in the GCC, has announced the successful closing of its Founding Shareholders Circle investment round, which values the firm at $120 million. The round, completed in under six months since the company’s launch, was oversubscribed, reflecting investor confidence in BlueFive’s strategy and leadership.

The firm’s founding investor base includes 25 institutions and family offices, among them prominent merchant and royal families from the GCC and renowned financial leaders from North America, Europe, and Asia. Due to heightened demand, the offering was subsequently expanded.

Since its establishment at the end of 2024, BlueFive Capital has grown rapidly, now overseeing more than $650 million in assets under management. The company operates with a 27-member team spread across London, Bahrain, Abu Dhabi, Dubai, Riyadh, Jeddah, Singapore, and Beijing.

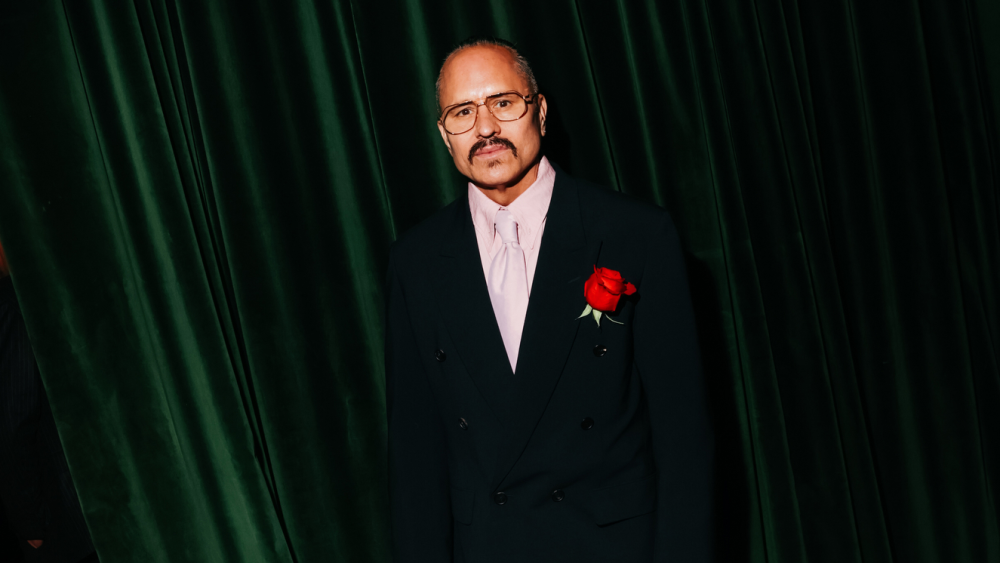

Hazem Ben-Gacem, Founder and Chief Executive Officer of BlueFive Capital and former co-CEO of Investcorp, commented:

“This overwhelming confidence from 25 blue-chip shareholders validates our team’s expertise and our strategy to disrupt the value chain in high-growth financial markets. The GCC is our launchpad, but our vision is hemispheric: connecting institutional-grade platforms to underserved capital markets driving the next wave of global prosperity.”

BlueFive Capital’s Board of Directors includes key regional and international figures. Sheikh Mohamed Bin Isa Al Khalifa, former head of Bahrain’s national pension fund, serves as Chairman. Lord Gerry Grimstone, former UK Minister of Investment, and Sheikh Mubarak Abdulla Al-Mubarak Al-Sabah of Kuwait act as Vice Chairmen, reinforcing the firm’s positioning across the Middle East, Southeast Asia, and China.

With a global mandate and strong regional roots, BlueFive Capital is positioning itself as a next-generation asset manager, bridging institutional capital with underbanked markets and contributing to the emerging global investment landscape.