UAE-based fintech platform OCTA has secured a $20 million credit facility from the Sukna Fund for Direct Financing (SFDF), aimed at powering embedded working capital for eligible SMEs across Saudi Arabia.

The new funding enables short-term financing directly from within OCTA’s platform, allowing businesses to get paid the moment an invoice is issued or a payable is due—without the delays or complexity of traditional banking systems.

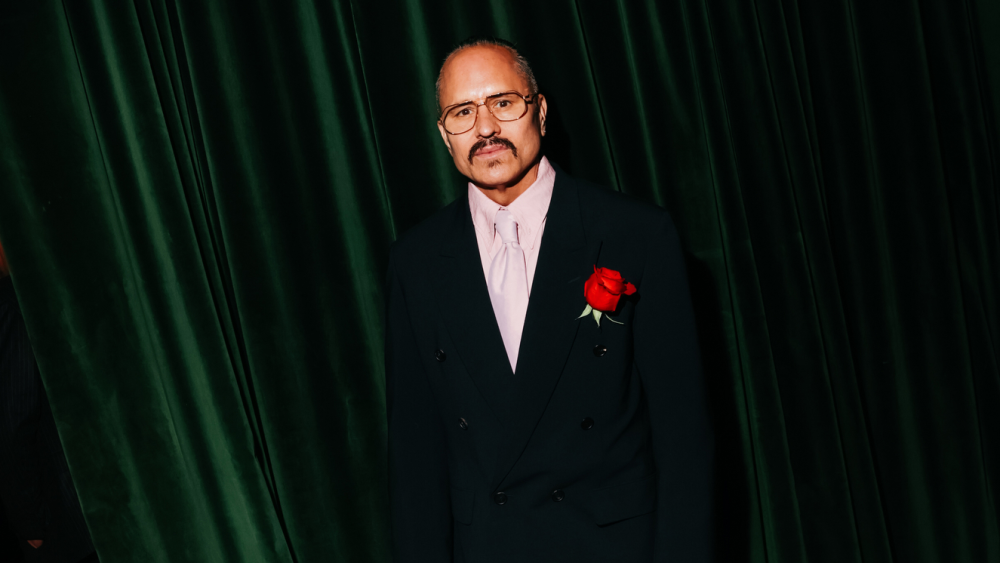

“Most SMEs don’t fail because of a lack of revenue – they fail because their cash is locked up for months,” said Jon Santillan, Co-Founder and CEO of OCTA.

“With Sukna, we’re embedding capital exactly where it’s needed—at the core of financial operations.”

Nupur Mittal, Co-Founder, added:

“We built the financial ops layer that automates how money moves—and now, we’re automating how it gets funded.”

Founded in 2024, OCTA has evolved into a full-stack contract-to-cash solution covering invoices, payments, collections, and now credit. Since launching operations in Saudi Arabia in Q1 2025, OCTA’s client base has grown 4x in just six months, serving over 500 companies, including Careem, Lean Technologies, ZenHR, Gameball, and MoneyHash.

To date, OCTA has processed $290 million in invoices and over $50 million in payments.

The $20M credit facility will officially launch in Q3 2025, exclusively through the OCTA platform, with fully automated onboarding and repayment tied to real-time receivables.

Sukhdev Hansra, Head of Asset Management at Sukna Capital, noted:

“OCTA offers a smarter capital distribution channel that works in sync with how SMEs operate. It’s capital that flows as fast as business does.”

Previously, OCTA raised $2.2 million from top investors including Quona Capital, 500 Global, Plus VC, Sukna Ventures, Sadu Capital, and strategic angels from Careem, Google, Amazon, Sary, and Tap Payments.

This funding supports OCTA’s ambition to become the financial infrastructure layer powering SME growth across the MENA region.