Mantra, a leading blockchain platform designed to tokenize real-world assets, has announced the launch of its investment fund, the Mantra Investment Fund “MEF,” with a target capitalization of approximately $108.8 million.

This strategic initiative is aimed at accelerating the growth and adoption of projects within the Mantra ecosystem.

The announcement follows Mantra’s milestone as the first decentralized finance platform to obtain a virtual asset service provider license from Dubai’s Virtual Asset Regulatory Authority (VARA), enabling it to operate as a virtual asset exchange and offer brokerage, trading, management, and investment services.

Over the next four years, the Mantra Investment Fund will invest up to $108,888,888 to support high-potential blockchain projects across the globe. Acting as a strategic growth engine, the fund will provide capital to startups and major investment firms alike.

Investment opportunities will be sourced through Mantra’s extensive network of partners, including leading incubators, accelerators, and venture capital firms such as Laser Digital, Shorouq, Brivan Howard Digital, Valor Capital, Three Point Capital, Amber Group, Manifest, UP Venture, Damac, Fusion, LVNA Capital, and Forti.

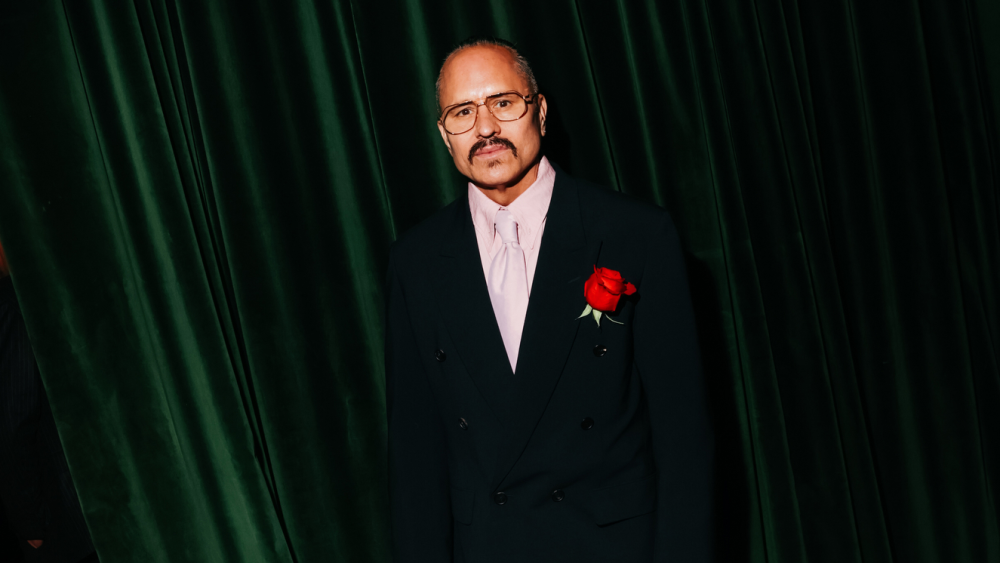

When asked about the maximum funding per company, Mantra CEO John Patrick Mulin told CNN that the equity capital will be provided by a mix of partners. He added, “There is no minimum or maximum amount—the choice of funding for any company will generally reflect our confidence in its ability to meet the needs of our ecosystem and the requirements of global real-world asset value chains (RWA).”

In addition, Mantra’s native token “OM” experienced a remarkable surge last year, ranking it among the top 10 cryptocurrencies in terms of gains in 2024. Its price jumped from around $0.65 in April 2024 to over $6.50 in April 2025, while Mantra’s market capitalization has now exceeded $6 billion, placing it 21st among the world’s largest cryptocurrencies.